75 Creative Ways to Save Money on a Tight Budget

Our readers always come first

The content on DollarSprout includes links to our advertising partners. When you read our content and click on one of our partners’ links, and then decide to complete an offer — whether it’s downloading an app, opening an account, or some other action — we may earn a commission from that advertiser, at no extra cost to you.

Our ultimate goal is to educate and inform, not lure you into signing up for certain offers. Compensation from our partners may impact what products we cover and where they appear on the site, but does not have any impact on the objectivity of our reviews or advice.

Saving money, it turns out, can be a challenge at first, but once you get in the groove of saving money, it can actually be fun. Here are 75 money-saving tips you can start using today.

Our mission at DollarSprout is to help readers improve their financial lives, and we regularly partner with companies that share that same vision. If a purchase or signup is made through one of our Partners’ links, we may receive compensation for the referral. Learn more here.

There isn’t a person on this Earth who hasn’t thought, “I wish I could save more money.”

However, wanting to save money and learning how to save money are two very different things. Many of us want to have better financial habits and dream of long term wealth. Yet, those initial steps often stop us.

Saving money can be a challenge at first. But, that doesn’t mean it’s an impossible skill to learn. Once you learn how to save money, it gets addicting. You start to wonder how you can save in many different aspects of your life.

You watch your savings accounts grow and then your savings enable you to pay off debt. Suddenly, after months and years of good savings habits, you find yourself with excess money that you can generously give to others and make the world a better place.

Of course, it’s important to realize everyone is different. Some people learn how to save money from a very young age. Other people watched their parents struggle and live paycheck to paycheck. I truly believe some people are born spenders and some are born savers, regardless of how they’re raised and what their overall life values are.

The key is to learn the basics of saving money first, which will help you organize your finances. Then, it’s time to do a deep look inward at how you view money emotionally.

Once you realize your triggers and how your spending habits affect your life, you become more aware and more willing to make positive changes. Then, once that’s done, you can learn how to save strategically in just about every area of your life, from buying a car to lowering your electric bill.

All of this information is below, listed one step at a time. By the time you’re finished reading this, you’ll not only understand the mechanics of saving money, but you’ll have a strong understanding of why it’s important to you and how to geat there.

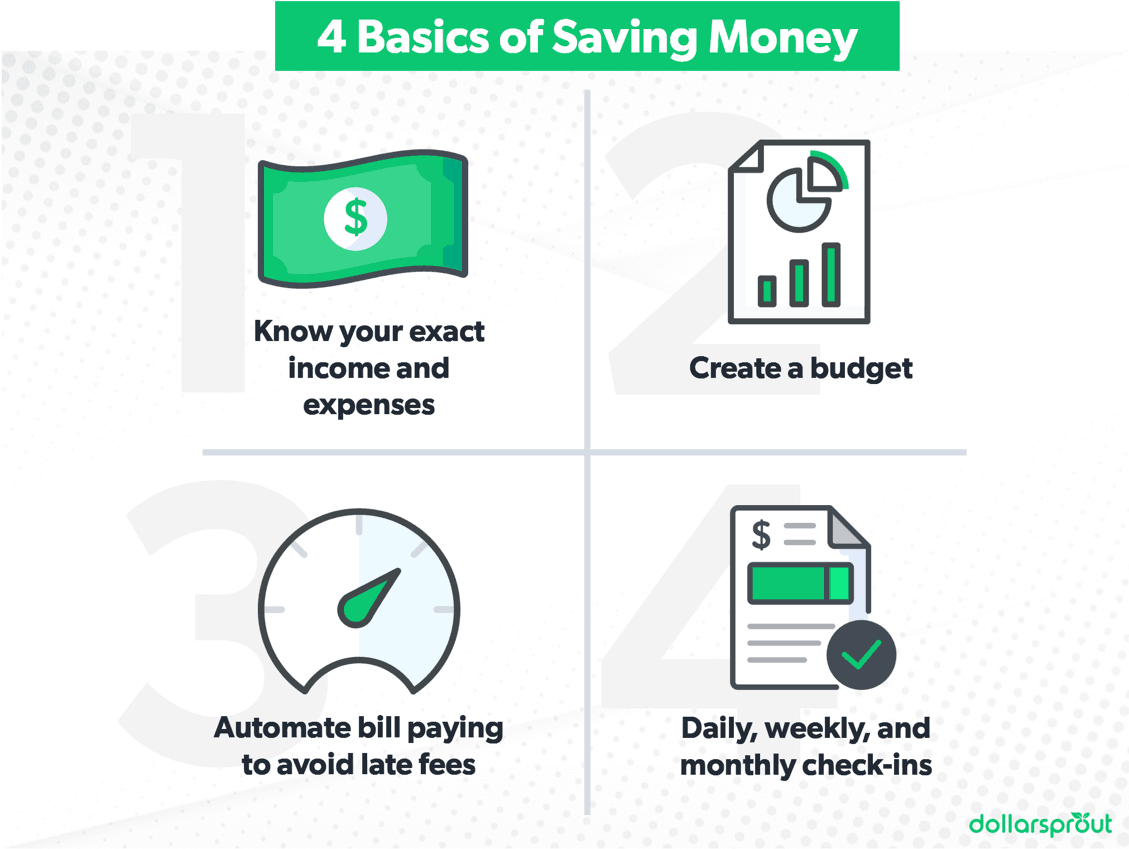

How to Save Money: Start with the Basics

Before you can enjoy seeing piles of cash in your bank account à la Scrooge McDuck, you have to learn the basics of how saving money works.

1. Know your exact income and expenses

Without a doubt, the best way to start saving money is to learn exactly how much money you have coming in and exactly how much money you have going out. Now, you probably have a rough idea of what your income is or the number on your paycheck. But, it’s time to look even closer.

What number exactly is hitting your paycheck each payday? Then, what number exactly is going out in bills and expenses? There are several ways you can track your expenses.

- Use An App: Mint, YNAB, and EveryDollar are popular expense-tracking apps.

- Use a Pen and Paper: Go old school with a handy notebook and write down everything you spend.

- Download an Excel Spreadsheet: Lots of people like using Excel to see their progress over time.

- Use Tiller: This is kind of a mix of an app and an Excel spreadsheet. Tiller will collect your information and create spreadsheets for you.

2. Create a budget spreadsheet

Once you have a strong understanding of your income and expenses, it’s time to make a budget spreadsheet and apply the information you just gathered. For example, maybe you found out that you spend $500 more than you earn each month. With a budget, you can input your income and your expenses, scan the list, and find categories where you can cut back.

For example, you might see that you have a high cable bill or a high car insurance bill. Those are companies you can call to try to get your bills lowered to create more breathing room in a budget. You won’t be able to do this until you see all the numbers in one place.

Lots of people tell me that they really don’t want to know the numbers, and I get it. It can be nauseating to think about how much money you spend every month unintentionally (I feel this way every month when I realize I’ve spent $1,000 on food…again.)

Yet, knowledge is power, and the more you know, the more you realize where your budget is weak. That will allow you to be more aware day in and day out as you go about your regular spending.

3. Automate whenever possible

Younger generations are big fans of automation, and older generations are still skeptical about it. I personally pay every bill I have automatically except for my daughter’s ballet class tuition (just waiting on her teacher to get on the automation bandwagon!). I also like to save automatically.

We are emotional creatures and sometimes we know what’s best for us financially, but we don’t do it. We know we should save some of every paycheck but then other things come up. When you learn more about automating you can ensure you save without having to think about it. That’s when saving money becomes relatively simple.

Pro-Tip: Automate your savings abilities while online shopping by using the DollarSprout Rewards cash back browser extension. This free tool built by us offers users the opportunity to earn cash back from over 15,000 online retailers, in addition to any other credit card cash back deals, promos, etc.

4. Daily, weekly, and monthly check-ins

When it comes to the basics of saving money, the last component is to check in with your money. It’s not enough to create a budget or automate your savings. You have to look at everything regularly. At first, that might mean daily tracking your spending. Then, it might mean weekly tracking. Eventually, you might be able to check in only once a month.

However, you do need to make sure you aren’t being charged twice for something, that all automatic bills really did get paid, and to check for fraud. This habit will help you catch any financial inaccuracy, which can definitely save you money in the long run.

Strategies and Challenges for Saving Money

For many people, saving money can be a little…boring. So, in order to make things more interesting, you can take part in money-saving challenges or savings strategies that can make the process a little bit more fun and interesting. Below are some of my favorite strategies and challenges that can help you save money.

5. Use the savings bucket strategy

Note: There is a savings bucket strategy and also a different retirement bucket strategy you can learn about when you start planning your retirement savings. In this section, I’m discussing a savings bucket strategy.

A savings bucket strategy is when you have multiple savings accounts or savings buckets so you can very clearly see your financial goals. I have anywhere from 3-6 savings buckets going on at one time.

This strategy works really well for goals because it encourages you not to dip into your savings. For example, I saved $10,000 during my pregnancy with my twins because I put money in a savings bucket labeled “Twins.”

The name on the savings bucket ensured I didn’t dip into it for vacation or shopping for new shoes. When your savings bucket is for one specific thing, you’re more likely to keep contributing to it (and not withdrawing from it) until the bucket is full.

6. Do a no-spend challenge

A no-spend challenge is where you decide to only spend money on essentials for a specific amount of time. So, people can have no spend days or no spend months if they’re taking part in this challenge.

Some people like to use a calendar and put a big X on the days where they don’t spend any money. The idea is to bring awareness to the spending you do on little things.

Related: 52-Week Money Challenge: How to Save $5,000 This Year

7. Cash-only challenge

There are many studies that show you spend less money when you use cash, not cards.[1] So, having a cash-only challenge can help you save more of what you have. For this challenge, you can leave your automatic bills as they are, but take out cash for clothing, groceries, eating out, entertainment, and more to see if the cash envelopes encourage you to save more money.

8. Save your change challenge

Once you start using more cash, you can then take part in a save your change challenge, where you collect all your loose change to see how much you can save in a month or even a year.

You can make it a competition with your family members or friends; or perhaps agree that you’ll all go out to eat together using the change you’ve collected at the end of the year.

9. The accountability partner strategy

Whether you’re single or married, one of the best ways to start saving money is by using the accountability partner strategy. This means you can pick one person to go along with you on this savings journey and who keeps you accountable for your goals.

It can be a co-worker who agrees to bring a brown bag lunch with you and sit with you at lunchtime. It can be your spouse who agrees to monthly budget check-ins. It can be your mom or your sister who wants you to succeed.

Regardless of who it is, a good accountability partner can mean the difference between you achieving your savings goals or abandoning them.

Related: Should You Marry a Spender If You’re a Saver?

The Emotional Aspect of Saving Money

10. Know your “why”

You can save money in many ways, like buying cheaper gas or only going to see matinee movies. But at the core of each money decision is a reason for why we want to save money to begin with.

When you take the time to know your why, you can save money much faster and easier. You can make quick decisions about saving money because your why is at the forefront of your brain. And your reason why you want to save may change over time. For now, you may want to save money so you can get out of debt or get current on your bills. In the future, you might want to save money because you want to retire early or buy a vacation home.

Your why is important because it helps you make everyday decisions like whether or not to buy a raffle ticket at the fair or a cup of coffee. When you have a reason for saving that’s bigger and more profound than daily wants, you’ll be more adept at making the right financial choices for you.

11. Assess your childhood experience with saving money

If you want to dig deep and really understand your relationship with saving money, look back to your childhood. Some people grew up in families where they saved consistently but did so at the expense of enjoying everyday life. Other people grew up in families who didn’t save at all and struggled living paycheck to paycheck.

Whether or not your family actively talked about saving money, you absorbed money lessons from them. You saw how saving, or the lack thereof, affected your family growing up.

When you assess your childhood experience with saving money, you can better understand your own savings tendencies. You can decide to emulate your parents or change a pattern.

Either way, much like having a why, understanding how your childhood affects your savings patterns is an important component to saving more money.

12. Identify spending triggers

Each one of us has a spending trigger that leads to money problems. In order to save more money, take note of the times you spend on things outside of your normal budget.

Ask yourself what you’re feeling as you buy the item. Are you stressed? Happy? Trying to make your day better? Once you know the feeling behind your spending, you can be more aware of it and redirect it when the feeling bubbles up.

An easy example of a spending trigger is going to buy a pint of ice cream after a bad day. Another example is scrolling Instagram late at night and making a snap decision to buy shoes online after seeing an influencer wear them.

13. Set big (but achievable) savings goals

Most of the time, we sell ourselves short. We are afraid to make big savings goals because we don’t want to fail. However, goal setting is a great way to save money. It keeps you accountable.

Achievable goal setting is more than just thinking, “It would be nice if I could save $10,000 this year.” It’s about setting measurable and achievable goals and then breaking those goals down into smaller checkpoints that you can tackle one by one. As you achieve smaller goals, you build momentum. You build faith in yourself. That’s how you accomplish bigger savings goals, so don’t be afraid to make some.

Improve Your Credit

14. Check your credit report

Why should you check your credit score when you want to save money? Your credit history and credit score are integral parts of saving money long term. When you have a solid credit history and good credit score, you qualify for lower interest rates when buying a car, buying a home, or anything else that carries a loan.

A good credit score can save you thousands of dollars over the course of your lifetime when you borrow money for these big-ticket items. So start saving money by simply checking your credit score for free.

15. Fix any adverse accounts on your credit report

Again, when you have a good credit score and a clean credit report, you can get better interest rates on loans, saving you money in the long term. The adverse account section on your credit report, usually found near the top of your report, is extremely important. If you have any items in this section, take the steps now to clear them.

You can have adverse accounts even if you’re generally responsible with money. For example, I once got declined for a credit card, checked my credit report, and found out my local public library reported me to collections for not returning an audiobook.

I borrowed the audiobook when I was in graduate school and since I moved, I didn’t receive any notices in the mail. Luckily, I found the audiobook in storage, mailed it back, and the library requested that the adverse account be removed from my credit report.

16. Make your payments on time, every time

We all know we’re supposed to pay our bills on time. It’s the right thing to do and your payment history makes up 35% of your credit score. You could still have a decent credit score (even if you currently have debt) if you have a solid payment history since it makes up such a big percentage of your score.

And, it makes sense, right? Lenders want to know they can trust you to make payments on time. If you’ve proven that with your payment history, they’re more willing to offer you a lower interest rate because you’re a lower risk to them.

17. Improve your credit utilization

The other big part of your credit score is your credit utilization. Credit utilization refers to how close you are to your credit card limits, and this makes up a whopping 30% of your credit score.

Experts advise keeping a utilization of no more than 30%. The lower, the better. Use a credit utilization calculator like the one below to see what yours looks like.

Someone who has maxed out credit cards won’t have a good credit utilization. A great way to improve your score quickly is to pay down debt and free up “space” on your credit cards. Improving your credit score by lowering your credit utilization can help you save money on loan interest down the road.

Money-Saving Tips When Buying a Car

18. Buy used

New cars lose 10% of their value in the first month of ownership.[2] Therefore, you can save money by buying a used car, even if it’s only been used for a few months. Cars are one of the most expensive items we own that actively go down in value.

My husband and I both drive used cars, and they both have more than 100,000 miles on them. We have no plans to trade them in anytime soon for something newer and shinier.

19. Do your research ahead of time

And, you can use all of that information to see whether or not the car you’re looking at is a good deal. I did a lot of research on the car I drive now, and I found one dealership selling it for $1,000 under the Kelly Blue Book value. So, I went there to buy it.

20. Get pre-approved for a loan

If you plan on taking out a car loan, you already know from earlier in this post that the better your credit score is, the better interest rate you can potentially get. In order to see where you stand, take the time to get pre-approved for a loan before going into the car dealership.

You can compare rates from dozens of online lenders, see what you qualify for, and go into the dealership already knowing you’re approved for a certain amount. This can help you save money because it gives you many more lending options than what the dealer can offer you.

21. Buy your next car in cash

Buying a car in cash gives you strong negotiating power. Even though car dealerships make money from financing cars, they still like getting lump sum payments for cars on their lot. Buying a car in cash saves you money on interest and gives you more negotiating power at the dealership.

22. Shop around for car insurance

When you buy a car, you also have to get car insurance. Shop around for car insurance ahead of time, and pay attention to the introductory rates. Many car insurance companies offer lower introductory rates but raise them after the first year. Make sure to ask lots of questions about what’s covered under each level of insurance to make sure you’re getting the best deal.

Pro tip: Use a rate comparison site like RateKick to compare deals, and make sure you have the DollarSprout Rewards cash back browser extension so that you can save even more.

Money Savings Tips for Homeowners

23. Get a smart thermostat

Getting a smart thermostat like a Nest does have an upfront cost, but over the years, it can save you money on your home energy costs. Smart thermostats learn your habits and make it easy for you to adjust the temperature of your home while you’re away. So, if you forget to turn down the heat on your way to work, you can adjust it from your phone instead of paying to heat a house you’re not spending time in during the work day.

24. Switch to LED bulbs

Like a smart thermostat, LED bulbs do cost a little bit more upfront. However, switching your light bulbs to LED saves you money on energy costs and can last years longer than traditional light bulbs.

25. Close your blinds

If you keep your blinds closed in your home, it keeps your home cooler, especially in the summertime. If the sun increases the temperature of your home, your air conditioner has to work harder to keep your home cool, which costs you more money.

26. Monitor water usage

A running toilet or a leaky faucet might seem like issues you can ignore, but you’re actually letting money go down the drain. Take the time to repair these issues when they happen or you might notice an increase in your water bill over time. You can also lower the temperature of your hot water heater to 120 degrees, which can help save money over time.

27. Get energy-efficient appliances

These days, there are many energy-efficient appliances available on the marketplace. I recommend waiting until they go on sale or asking for discounts at the store if you buy three at once. If you slowly convert your appliances to energy-efficient appliances one by one, over time you can save hundreds if not thousands of dollars on energy costs in your home.

28. Do regular home maintenance

This goes without saying, but as a homeowner, I know that some maintenance tasks can fall through the cracks. It’s easy to put off cleaning the gutters or changing the air filters, but these tasks can cause bigger, more expensive issues down the road if you don’t take care of them. You can find many lists online with home maintenance tasks. Go through them one at a time — they’ll save money in the long run and can even increase the value of your home.

Money Savings Tips for Parents

29. Compare daycare costs to staying at home

One of the biggest expenses parents have right away is childcare costs. Childcare costs are extremely expensive, and it’s something you should research and consider well before having children. One thing to compare is the cost of daycare vs. having one parent stay home.

Depending on your income, you might be able to decide to stay home if childcare costs are equivalent to your income. I stayed home with my twins, but I worked to build a business I could do from home before doing so. That way, I could still pursue my career and take care of them at the same time. That decision was years in the making and took a lot of work outside of my regular day job to make it happen. If you can find a way to earn money online, you might be able to make an income and stay home with your kids full time.

30. Don’t fall prey to the latest gadgets

There is an overabundance of gadgets on the marketplace claiming to make parent’s lives easier. My advice is to wait to buy things until you need them. It’s tempting to put a lot of expensive items on your baby registry, but you might discover you don’t need them (or that your baby doesn’t like them.)

Remember, babies have existed for thousands of years without special night lights or toys with blinking lights. Keep things simple at first to save money and buy items as needed.

31. Try cloth diapers

Full disclosure: I used cloth diapers for my twins. I wish I could say it’s because I wanted to be more environmentally conscious. The truth is that it was my first year of self-employment, and my income wasn’t what it is now. My husband was a medical school student.

We had two babies, and we wanted to save money. We asked for cloth diapers as baby shower gifts, and we were able to wash and reuse them for over a year. This saved us more than $1,000 on the cost of diapers in my twins’ first year of life. It was a lot of work, but it helped us when we had low incomes.

Related: 16 Places to Get $1,000+ in Free Baby Samples

32. Make your own baby food

Like everything else, baby food is expensive if you buy it from the store. But, you can make your own mashed sweet potatoes and peas. There are tons of expensive gadgets you can buy to make them, or you can just use your own regular blender, put the baby food in ice cube trays, and save the frozen cubes for a later day.

33. Stick to the four gift rule

When your children are old enough to enjoy Christmas, try out the four gift rule. This rule says you only buy four gifts for your kids: something they want, something they need, something to wear, and something to read. You can also add in a gift or two from Santa. This gift rule covers all the bases to ensure your child has plenty of presents under the tree without going overboard.

34. Choose one extracurricular activity

There’s a lot of pressure these days to have your children in multiple different extracurricular activities. I know some young children who are in art class, Spanish class, piano classes, and sports. While exposing your kids to many different interests is great, it also gets expensive. (It’s also exhausting as a parent to bring them to all these activities.)

We chose one activity for each of our kids. My son plays tennis and my daughter goes to ballet. This allows them to focus on one thing, get better at it, and enjoy it more and more over time.

35. Shop gently-used clothing

I’m a big fan of buying gently used clothes for my kids. I like to shop using apps like Poshmark or Mercari. I also shop at Once Upon a Child, which is a chain of stores full of gently used name brand clothes.

I love it when other people buy their children Burberry and Polo shirts and then sell them to consignment stores. I get to pick them up for 90% off their retail price. My kids don’t know the difference, and I save a lot of money as they grow.

Related: 10 Legit Ways to Get Free Clothes Online

36. Swap babysitting with other moms

If you don’t live near family, it can be pricey to get a babysitter for date night or doctor’s appointments where you don’t want little ones running around. So, try to swap babysitting with other families.

Maybe you get to know another family who lives on your street and offer to watch their kids one night if they watch your kids on another. This gives each of you an opportunity to have a cheap date night without paying a premium for a babysitter.

37. Have affordable birthday parties

My twins are almost five years old, and I still haven’t thrown them an official birthday party yet. This is another area where parents tend to go overboard. I’ve seen many one-year-old birthday parties with inflatables and ponies.

While that’s amazing if you can afford it, it can be harmful to you financially if you can’t. There’s no reason to go into debt for a birthday party (and you’re not a bad parent if you decide not to have one.)

38. Research free or low-cost entertainment activities

There are so many free activities you can do with your kids. One of my favorites is taking my kids to our local public library. There, they can play with toys, pick out books, and see the fish in the fish tank.

The library also offers several discounts to local museums you can take advantage of. Simply ask a library for more information about the perks that come with your library membership.

Related: 40 Free Things To Do When You’re Out of Ideas (and Money)

Money Savings Tips for the Self-Employed

39. Work at home or at the library

Co-working spaces are great because you can surround yourself with other entrepreneurs but they also come with a membership cost.

Also, working in coffee shops is fine too (I happen to be writing this in a coffee shop right now) but it can lead you to spend money on pricey lattes and food (guilty.) So, work at home or at the library mostly if you want to save money and cut costs.

40. Set aside money for taxes first

There’s nothing worse than getting to tax day and realizing you owe a lot more money than you originally thought. Early in my self-employment days, I had a rather unpleasant surprise on tax day, and since then, I’ve saved 30-35% of my income first before paying myself.

If you can’t pay the taxes you owe, you might get hit with expensive fees or you might be tempted to pay for them with a high-interest rate credit card. So, make it a habit to save your taxes first to avoid this.

Related: What Is a Sinking Fund and How Do You Use One?

41. Regularly reevaluate your expenses

As entrepreneurs, it’s natural to try out new software, courses, products, and even employees. However, each month take note of your expenses. See what’s working for you and what isn’t. Make sure you’re aware of recurring subscriptions and taking note of your cash flow. You can save money by only keeping the expenses you really need that benefit your business.

42. Save for retirement

It’s a lot easier to save for retirement when you work a full-time job with an automatic 401(k) withdrawal and employer match. Yet, that’s not available to most people who are self-employed.

Still, take the time to research your retirement account options, learn the difference between a 401(k) and an IRA, and try to automate the process as much as possible to encourage yourself to save more.

Money Savings Tips for the Grocery Store

43. Check your fridge and pantry before you shop

This is such a simple tip, but it can save you so much money. I can’t tell you how many times I bought a dozen eggs or several boxes of chicken stock without remembering that I had them in my fridge at home. Checking your fridge before you go can also help prevent food waste in addition to saving you money.

44. Meal plan

Many people think meal planning takes a long time, but it really doesn’t. All you need to do is take note of the food you have and think of dinners you can make with what you already have on hand.

Make a grocery list with the additional ingredients you need to complete the list, and make a note of what you’ll have for breakfast, lunch, and dinner each day. Meal planning helps you save money because it reduces the likelihood that you’re going to order takeout.

45. Bring a list

Bringing a list to the grocery store is crucial for saving money, and sticking to the list is obviously important too. When you stick to your list and stay disciplined, you don’t allow yourself to throw Oreos into your cart or buy things you don’t need.

I also recommend going to the grocery store alone if you have children because they are equally as guilty of throwing things into the cart!

46. Using grocery apps

There are numerous apps available today that can help you save money on your groceries.

Ibotta is one of the most popular ones currently. Learn more about how this app works in our Ibotta review.

Related: 10 Apps Like Ibotta to Save on Groceries

47. Stop buying sodas and alcohol

I admit, I’m a mom who likes to drink wine. Yet, I realized that buying wine every time I went to the grocery store really increased my bill. It also made me tired at night, which meant it was harder for me to write after my kids went to bed. So, these days, I save wine for special occasions, and I really don’t miss it that much.

I also don’t buy sodas or sparkling water at the grocery store. I buy milk and juice for my kids and occasionally some small water bottles for on the go convenience. This is a very simple way to save money and also to be healthier and reduce my caloric intake.

Related: I Stopped Spending Money for 30 Days, Here’s What Happened

Money-Saving Tips for Traveling

48. Be flexible

When you’re flexible with your travel dates and the locations you want to visit, you can save a considerable amount of money. Sometimes, I like to let the prices dictate where I travel. That might mean on a given week of the year we have available to travel, plane flights to Florida are much cheaper than plane flights to Chicago, so we pick Florida.

By being open and more adventurous, we can still have a great time traveling but at a price that fits our budget. Skyscanner is my favorite website to use to search for cheap flights because it lets me search “Everywhere.”

49. Rent an Airbnb

When you rent an Airbnb while traveling, you can save money on your accommodations. Vacation rentals tend to have kitchens, which means you can make a lot of your meals at home. This can free up money to visit museums, see a game, and more.

Related: Our Complete Guide to Becoming a Profitable Airbnb Host

50. Use credit card rewards

If you know how to use a credit card responsibly, then you might benefit from credit card rewards. You can sign up for new travel credit cards, and use the signup bonus to get free flights, hotels, excursions, and more. Keep in mind that this is a hack for people with excellent credit scores who pay off their credit cards at the end of each month.

51. Double dip with cash back offers

While buying on credit can be risky for some, there’s zero risk in using a desktop cash back browser extension to make everyday purchases — including travel. With DollarSprout Rewards, our readers can quickly and easily earn 10% cash back or more on purchases at 15,000 popular retailers. Better yet, if there’s a working promo or coupon code available anywhere on the web, the browser extension will find and apply that too.

By combining the two savings methods [cash back credit card], one can reasonably expect to claw back hundreds of dollars per year they would have otherwise thrown away. A true no-brainer to use!

52. Go camping

Camping is a great way to have a fun vacation without spending a lot of money. You can camp in the wilderness or find a campsite that has showers and bathrooms. Bring your own food, sit around the campfire, and enjoy time with your family on a dime.

53. Plan free or low-cost activities

Just because you’re traveling doesn’t mean you have to buy expensive massages or go on thousand dollar excursions. Do your research to find free museum days, restaurants that allow kids to eat free, and more. There are so many ways to save if you plan free or low-cost activities while you’re there.

Related: 40 Cheap or Completely Free Things to Do With Friends and Family

Money-Saving Tips for Your Health

54. Get annual checkups

Annual physicals are typically included in most healthcare plans. Getting an annual checkup, even if you feel you’re healthy, can help spot potential problems early, which can save you money on medications, hospital bills, and more.

55. Stop smoking

Most people know smoking is bad for your health, but it also has a significant impact on your wallet. According to research from UC Davis, smoking one pack a day can cost you $2,000 per year and $80,000 over the course of forty years.[3]

56. Exercise regularly

Exercising is excellent for your physical and mental health. If you regularly exercise and get your heart rate up every day, you are helping to prevent chronic illness down the road that could be extremely expensive.

57. Buy generic medications

One way you can save money is by purchasing generic medications. Some pharmacies will automatically give you the generic version of medication but others won’t. So, it always pays to ask if that’s the best price for the medication. You can also ask your pharmacist if they know of any coupons available for your medication.

58. Buy over-the-counter medications on sale

I have a bad habit of buying over the counter medications at CVS because it’s a fast way to grab Children’s Tylenol when I need it. However, this convenience costs me every time. It’s far cheaper to buy basic medications at big box stores when they’re on sale.

Related: 7 Experts Share Their Best Hacks for Saving Money

Money-Saving Tips for Retirement

59. Start saving early

The earlier you start saving for retirement, the more savings you’ll have when you’re ready for retirement. It’s a simple concept, but many young people have other pressing financial burdens like student loans and taking care of young children. Still, if you can start saving early, even if it’s just a little bit, your savings will grow more due to compound interest and your future self will thank you.

Related: How to Start Investing for Beginners

60. Invest automatically

The easiest way to save money in general, not just for retirement, is to save automatically. No matter how great you are with saving money, automating your savings is still the best way to ensure it happens.

You can set it up with your employer to have a specific amount taken out of your paycheck every pay period and invested for you. This is a great and simple way to save more money for your future.

61. Take advantage of employer matches

Employer matches are free money. So, if you work a 9-5 job, and an employer match is one of your benefits, make sure you take the time to set up your retirement accounts so you can benefit from this.

62. Be aware of fees

More and more people are becoming aware of the fees that come with managed funds or 401(k) accounts. There are many low-cost brokers out there. Some of the most well known are Vanguard, Fidelity, and Charles Schwab.

These companies enable you to buy mutual funds and invest your money with lower fees than many of their competitors. A 1% fee from your financial advisor might seem low at first, but when you look at how much that will cost you over a 30 year investment period, you could be losing hundreds of thousands of dollars to fees.

Other Generic Savings Tips

63. Beware of recurring subscriptions

There is a service called Trim that will review your accounts and notify you of any recurring subscriptions you might have. You might not realize that you haven’t canceled your New York Times or Care.com subscription. That’s an easy way that Trim can help you save money.

64. Make your own laundry detergent

I don’t make my own laundry detergent, but there are many amazing concoctions online. If you’re looking to be more frugal in every aspect of your life, this is an easy way to do so.

65. Save for the holidays all year

The holidays come at the same time every year, and I love saving $50-$100 every month in a separate, high yield savings account earmarked for Christmas. This helps me set a budget around the holidays and prevents me from buying things I can’t afford using a high-interest credit card.

Related: 5 Ways to Still Enjoy Christmas If You’re on a Tight Budget

66. Pay your car insurance bi-annually

When you pay for your car insurance monthly, you usually pay more for it over the course of a year. So, consider paying for it every six months. You’ll have to budget for it ahead of time, but it will save you money over the course of the year.

67. Buy high-quality clothes

This might seem counter-intuitive because I’ve already mentioned my love of buying second-hand clothes. However, it’s important to mention because I usually buy secondhand, high-quality clothes. High-quality clothes that are well made with premium materials can last years longer than cheap clothes.

This is especially important when buying items like winter coats or boots. There are some companies, like Patagonia, that will repair clothes for you, enabling them to last decades.

68. Always check online coupons

There are so many online coupons sites available that search for deals for you. The Honey app is one of my favorites.

Simply add the Honey extension to your browser, and it will automatically check for coupons when you’re checking out on any website. It’s a very simple way to save money on your everyday purchases.

69. Cancel your cable

This is one of the most well-known money-saving tricks in the book. I personally haven’t had cable for about eight years, and I went four of those years without having a TV whatsoever. Now that the more affordable or free Netflix and Hulu exist, there’s really no reason to spend $60 or more per month on cable.

Related: 6 Legal Ways to Get Free TV or Heavily Discounted Cable

70. Refinance your federal student loans

Not everyone is a good candidate for refinancing federal student loans. For example, if you’re trying to get Public Service Loan Forgiveness, refinancing your federal student loans with a private lender would disqualify you for that.

However, if you’re not pursuing PSLF and understand the pros and cons of refinancing, you could lower your monthly student loan payment considerably by refinancing with a private lender.

71. DIY when you can

Insourcing, or completing tasks by yourself at home or your business is a great way to save money. Of course, it has its limits. You might be able to paint a room by yourself, but you might not want to rewire your electrical or change your plumbing on your own.

So, any time you are faced with a task to complete at home, ask yourself, “Can I do this on my own?” “How much money can I save by doing this on my own?” “Should I do this on my own?” Those questions will help you to decide if it’s worth it to DIY a task or not.

72. Buy term life insurance when you’re young

Many people don’t feel the need to buy term life insurance until they’re older or have several dependents, but it can save you money to buy life insurance when you’re young and healthy. The reason is you don’t know what the future holds.

You could contract a disease or experience an illness that will exclude you from life insurance in the future. The best time to get it is as early as possible when you’re as healthy as you will ever be. Term life insurance is relatively inexpensive and is a worthwhile purchase.

73. Bring snacks with you when running errands

Whenever I run errands, whether I’m by myself or with my kids, I always bring snacks. Otherwise, I might be tempted to make a Starbucks run or buy a granola bar in the checkout line.

These costs are, of course, minimal on a day-to-day basis. Yet, if you look at what you mindlessly spend on snacks over the course of a year, the cost could be substantial. A small habit change like this could save you over $100 a year!

74. Barter and negotiate

Bartering is when you trade goods or services with someone else without actually exchanging cash. And, negotiating is when you ask for lower prices on goods and services that you want.

Both of these money-saving methods have been around since the beginning of time, and you can still use them to your advantage. Furthermore, consider a price drop app like Earny — if the price a previously purchased item drops, the app will scan your inbox, do a price comparison analysis, and collect the savings on your behalf.

Related: DollarSprout’s Earny Review

75. Beware of ATM fees

ATM fees are rising. I use an online bank that refunds my ATM fees, but the ATM close to my house actually charges $4 every time I make a withdrawal. That’s a high amount, especially because I usually just withdraw $10 to tip my hairdresser (I rarely have cash on me.) Luckily, I get all those ATM fees refunded to me, but if you don’t, think about how much those fees are costing you each year. You can save money by using ATMs associated with your bank or getting cash back at places like grocery stores and Target.

There Are a Thousand Ways to Save Money

There are many, many ways to save money in dozens of different categories in your life. Believe it or not, there are even more ways to save money that aren’t included on this list. And, while it’s important to monitor your spending, be aware of energy costs, and keep your grocery bills in check. The most important aspect of saving money is one of the reasons I mentioned early in this post: knowing your why.

When you first know why you want to save money and what some of your biggest goals in life are, you’re more likely to be willing to follow all the other tips on this list. So today, take some time to evaluate your life, where you’ve been, and where you’re headed. Why is saving money important to you? What’s your reason? Then, use that reason to fuel your motivation to start following the other tips on this list for a more financially secure life!